October 21 - 23, 2025 | C. Baldwin Curio Collection by Hilton | Houston, TX

October 21 - 23, 2025 | C. Baldwin Curio Collection by Hilton | Houston, TX

American innovation is transforming the U.S. energy market, reshaping supply, demand, pricing, and investment. Breakthroughs across conventional and clean energy technologies are driving a more dynamic, decentralized, and diversified energy mix, positioning the U.S. to achieve true energy independence. These changes have already delivered over $115 billion in investment, 3.5 million jobs, and enough new capacity to power 170 million homes in just the past year. With electricity demand surging, fueled by AI, electrification, and data infrastructure, a resilient, domestically powered grid will be essential to stabilizing markets, reducing price volatility, and managing global risks.

At the same time, there is growing recognition that the conversation around clean energy deployment must shift from ambition to execution. To meet escalating energy demands, conventional and clean energy asset development must be aligned with realistic economic, technical, and market-based goals. Siting, interconnection, permitting, supply chains, and capital allocation must be addressed in practical terms—factoring in costs, scalability, timing, and regional grid needs. Markets must move beyond headline capacity targets and toward integrated planning that ensures new assets can be financed, built, and brought online when and where they’re needed most.

As the industry faces new deployment urgency The One Big Beautiful Bill Act (OBBBA) introduced significant changes to key clean energy incentives, and the market is scrambling to adjust project pipelines, capital stacks, and development timelines to meet new deadlines and compliance requirements. Uncertainty around trade, tariffs, and permitting reform is further complicating timelines. Developers, financiers, and suppliers are under intense pressure to make near-term decisions with long-term consequences—often without clear regulatory guidance or price stability. Every electron counts in the race to meet today's load growth, and the industry needs realistic conversations surrounding how we get there using any bankable asset type. The future grid must be an all of the above approach and now is the time to pivot plans and priorities in order to be effective.

This is a pivotal moment. The energy market is being reshaped in real time, and the window to make informed, strategic moves is closing fast. Now is the time to step away from reactive mode and engage with the full market picture.

Infocast’s inaugural Energy Independence Summit is uniquely positioned to meet this critical moment. By convening top leaders across energy, finance, and policy, the Summit provides a timely platform to cut through the noise and evaluate where the market is headed next. Attendees will gain critical insights into how capital is being deployed, which technologies and projects are emerging as the most viable under OBBBA, how domestic supply chains are affecting costs and timelines, and what regulatory levers may help stabilize the sector.

This is more than a conference; it’s a strategic reset. In a market under pressure and in flux, this is where clarity meets opportunity.

Get insights you won’t find elsewhere into what it will take to deploy, scale, finance and profit from energy projects and technologies in today’s climate.

✅ Analyze how projects across energy subsectors are being funded, financed, and transacted in the face of OBBBA’s changes to tax credits, shortened construction timelines, FEOC requirements, and the impacts of multinational tariffs.

✅ Get a comprehensive breakdown of the new rules for tax equity and tax credit markets, highlighting how updated contract structures are supporting project execution, catalyzing U.S. energy independence.

✅ Examine the drivers for energy generation independence: Understand how global pricing, domestic manufacturing, and commodities support the transition to a domestic energy future.

✅ Hear directly from top energy infrastructure capital, private, debt and tax equity investors, and leading developers across energy sources on how they are finding certainties in today’s political and economic landscape.

✅ Grasp the scale of today’s unprecedented load growth and what’s needed for deploying grid modernization, generation additions, and the timelines to energization necessary to achieve U.S. energy independence goals.

✅ Strategize with leaders directly engaged in the AI and data center expansion on the approaches needed to meet and power the U.S.’ ever-growing energy demand.

Did you Attend These Events?

Energy Independence Summit transforms the insights, strategies, and dialogue from those programs to meet today’s fast-changing regulatory and market landscape—so you stay ahead of the curve.

Hear from top industry leaders

and market stakeholders

Gain highly-relevant,

exclusive insights and updates

Connect with key decision-makers

and get deals done

Get visibility for your brand

Sponsor this Event

Contact Sponsorship

sponsorship@infocastevents.com

For registration questions

Group rates available,

for 3 or more attendees!

registration@infocastevents.com

Share your expertise

James Riley

Conference Producer

jamesr@infocastevents.com

10/21/2025, Tuesday

SUMMIT DAY 1:

The Current State of the US Economy, Policy & Incentives for Energy Independence

Defining Drivers for Energy Generation Independence: Global Pricing, Domestic Manufacturing & Commodities

Impacts of Changing Federal Policy & Regulation on Investment Strategies for Today's Energy Projects

Macroeconomics of Domestic Energy Independence and their Effects on the Markets

Presentation: Change in Law Risk

Meeting Demand Growth: Onshoring Power for Next Gen Hyperscalers, AI, & Other Large Energy Customers

Today’s Outlook on Domestic Fossil Fuel Production: Market Shifts, Export Momentum, and Power Price Pressures

Presentation: Power Market Analysis

OBBBA & Energy Independence: Implications of the Tax Equity & Credit Markets on US Investments

10/22/2025, Wednesday

SUMMIT DAY 2:

How the Push for Energy Independence Affects Investment Decisions

Investor Perspectives on Evaluating Emerging Clean Energy Technologies

Monetization Outlook: Timelines for Commercial Scale-Up Across Next Gen Energy Technologies

New Developments in Corporate Level Financing/Debt

Presentation: ROI Timelines in Asset Investment

Opportunities in US Manufacturing: How Big, How Fast, How FEOC?

Opportunities in Next-Gen Energy Hardware/Software & Clean Tech

Balancing Emissions Goals and Energy Independence: The Carbon Capture Equation

Cornerstones for Energy Independence: Investing in Grid Security & Cybersecurity

10/23/2025, Thursday

SUMMIT DAY 3:

Energy Project Development Execution - Planning for Tomorrow's Energy Resource

Generation Mix Needed for Resilience & Keeping Up with Load Growth

Presentation: Understanding Today’s Energy Demands Using Technology

Large Scale Solar & Wind Deployment: Maximizing Execution Strategies & Finding Pockets of Certainty

Opportunities in Storage: BESS Revenue Models & Financing, and Prospects for Non-Lithium Ion Technologies

Prospects for Geothermal, Nuclear & Other Firming Technologies

How Natural Gas Fuels National Energy Independence Progress

Grid Resilience & Decentralization: How Distributed Generation Resources Ticks Two Boxes

Enhancing Energy Infrastructure Through Smart Grid Technologies

FEATURED SPEAKERS

)

)

WHY ATTEND?

Unmatched Insights from

Industry Leaders

In-Depth Look at the Shifting Policy & Incentive Landscape

In-Depth Look at the Shifting Policy & Incentive Landscape

Actionable Investment & Project Development Strategies

Actionable Investment & Project Development Strategies

Prime Networking with Key Decision-Makers & Deal-Making Opportunities

Comprehensive Roadmap

to U.S. Energy Autonomy

Assessments on the various asset types needed to meet AI-driven load growth

PAST PARTICIPATING ORGANIZATIONS AT SIMILAR INFOCAST EVENTS

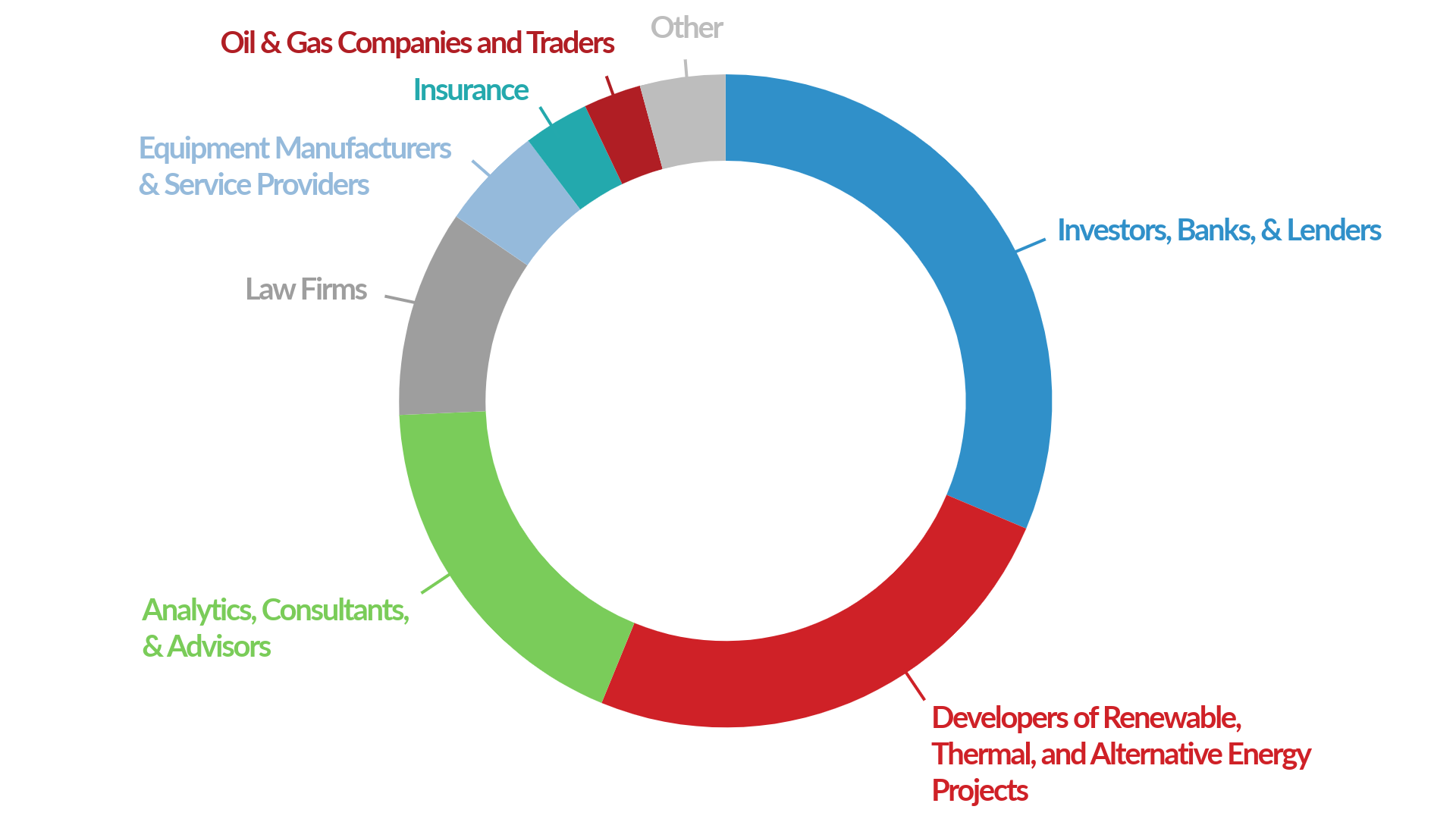

WHO SHOULD ATTEND?

Clean Energy & Storage Project Developers

Fossil Fuel, Alt Fuel & Hydrogen Developers

CCUS, Clean Transportation & Other Developers

Financiers, Debt & Capital Providers

Infrastructure, Equity & Tax Equity Investors

Alternative Investors, VCs & Asset Management Funds

Data Centers & Other Large Energy Users

Carbon-intensive Energy Companies & Industrials

Generation Facility Owner/Operators

EPCs, Construction Services,

Equipment Manufacturers & Providers

Clean Tech Companies & Other Service Providers

Consultants & Analysts

Government Agencies & Regulators

Law Firms

Insurance Providers

HEAR FROM INDUSTRY LEADERS & EXPERTS

venue

C. Baldwin, Curio Collection by Hilton

400 Dallas Street

Houston, TX 77002

Phone: (713) 759-0202

WARNING: Please do not book any guest rooms with third-party housing companies for this event. Infocast does not partner with outside housing companies, so we advise that you only book guest rooms directly through the venue using the details provided above.

sponsors

SUPPORTING ORGANIZATIONS

Looking for more information about this or upcoming events?

Please fill out the form below.

)