May 5 - 6, 2026 | C. Baldwin, Curio Collection by Hilton | Houston, TX

May 5 - 6, 2026 | C. Baldwin, Curio Collection by Hilton | Houston, TX

The tax credit and transferability market is entering a new phase of maturity following the implementation of the IRA and OB3, driving the emergence of more sophisticated deal structures across renewable energy finance. This evolution is broadening access to capital for a wider range of developers while attracting new corporate buyers motivated by both financial performance and long-term resilience and sustainability targets. As the market advances, opportunities are expanding to deploy efficient hybrid structures and specialized risk management and insurance solutions unlocking greater value for all participants.

However, OB3’s accelerated phaseout of key tax credits, coupled with uncertainty surrounding evolving FEOC regulations and unclear Treasury guidance, has introduced new volatility. Compressed transaction timelines and tightening liquidity are pushing developers to secure tax equity and transfer investments more rapidly and optimize their capital structures to manage rising costs. After a turbulent 2025 shaped by shifting demand and constrained capital, the stage is set for significant market transformation in 2026.

Infocast’s Tax Credits & Transferability 2026 is the premier forum convening top tax equity investors, financial advisors, platform providers, lenders, and insurers across the clean energy finance ecosystem. Over two days, industry leaders will examine how evolving policies and market forces are redefining tax equity and transferable credit transactions.

Attendees will gain actionable insights into the latest trends in structuring, pricing, and risk management, equipping them to optimize capital strategies, accelerate deal execution, and navigate an increasingly complex and competitive marketplace. Through expert-led panels, in-depth presentations, and forward-looking discussions, the summit will offer market forecasts through 2030, exploring scenarios from constrained credit availability to diversified technology deployment.

Stay ahead of the curve with the intelligence, strategies, and connections needed to thrive in a rapidly evolving tax credit environment.

Become a Sponsor!

Lawrence Silverstein

Director of Sponsorship

lawrences@infocastevents.com

Have questions?

We're here to help

registration@infocastevents.com

Become a Speaker!

Erin Dolleris Hall

Senior Conference Producer

erind@infocastevents.com

Save up to $800 with Early Bird Pricing

Group rates available for 3 or more attendees!

FEATURED SPEAKERS

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

*pending

HEAR FROM INDUSTRY LEADERS & EXPERTS

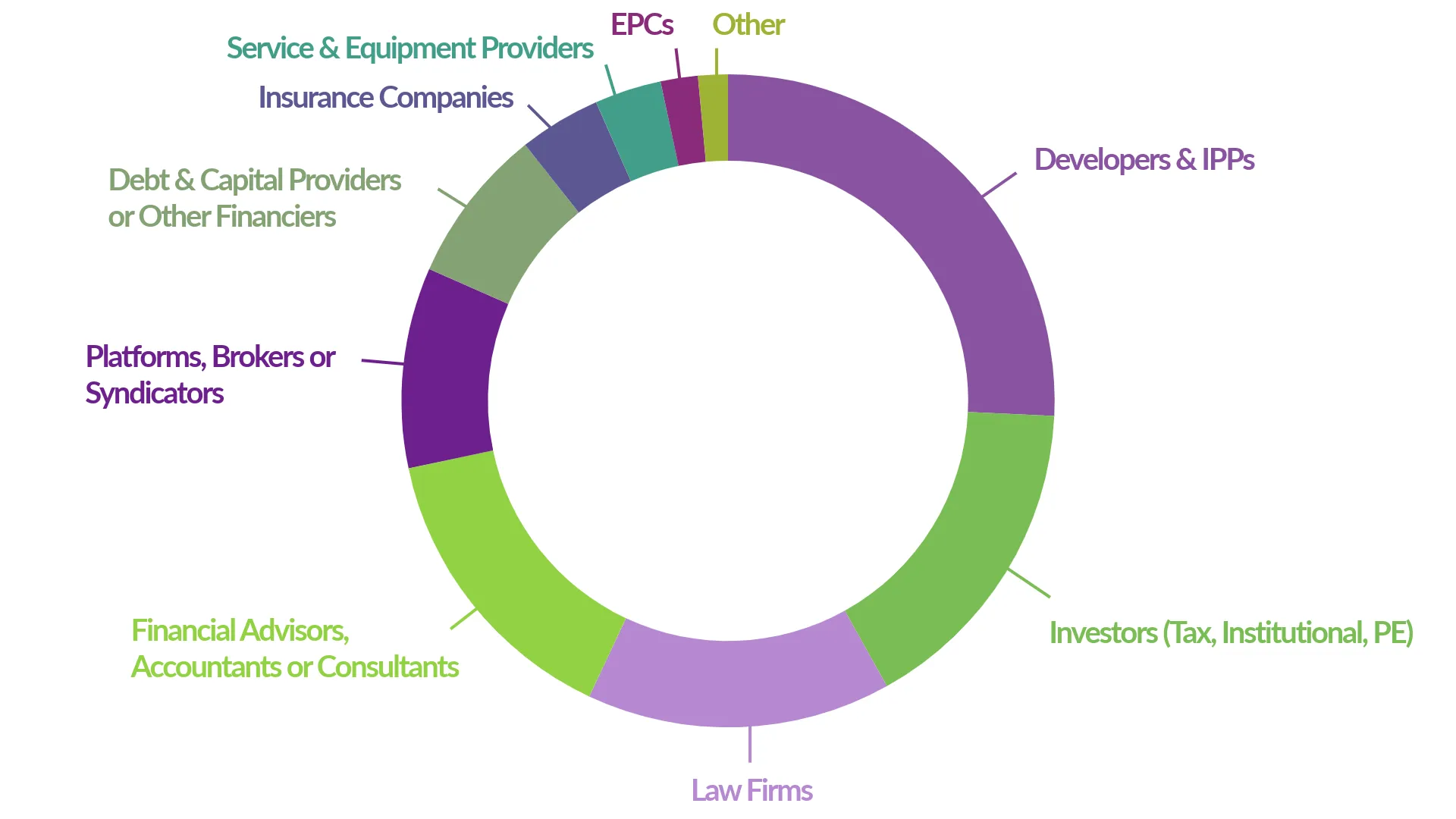

WHO SHOULD ATTEND?

Solar, Wind and Storage Developers

Insurance & Risk

Tax Investment

Investment Banks and Lenders

Asset Management

Consulting and Analytics

Engineering, Procurement and Construction

Clean & Alternative Technology Project Developers

Law Firms

Platforms

General Partners and Private Equity

Investment Advisors

Equipment Manufacturing & Suppliers

Utilities

PAST PARTICIPATING ORGANIZATIONS

2025 RECAP

venue

C. Baldwin, Curio Collection by Hilton

400 Dallas Street

Houston, TX 77002

Phone: (713) 759-0202

Room Rate: $224

Reservation Call In No: (713) 759-0202

Reservation Web Link: Check back soon for details!

Cutoff Date: Monday, April 13, 2026

Group Name: Tax Credit & Transferability 2026

WARNING: Please do not book any guest rooms with third-party housing companies for this event. Infocast does not partner with outside housing companies, so we advise that you only book guest rooms directly through the venue using the details provided above.

registration

*Discounts cannot be retroactively applied to an existing registration

Need help with registration?

Contact us at: registration@infocastevents.com | (818) 888-4444

)